From The Ashes.

When Dr. Shannon Mitchell set his goals at the beginning of 2020, like so many other doctors & practice owners, he never expected the interruption that would soon shake all our lives. But even before the appearance of COVID-19 on the scene, not all was idyllic in Mad River Eyecare.

“I had started a new practice when we first signed up with Silkin. Only a year into ownership, I was already feeling stagnant. I wanted us to GROW, and I knew I needed help.” – Shannon

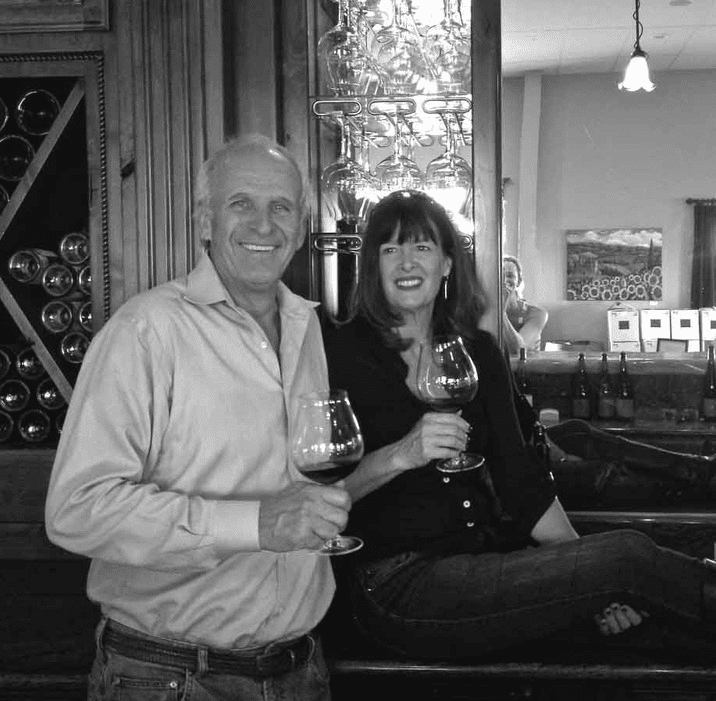

Lack of growth wasn’t the only problem his practice faced. When Shannon and his wife Molly began to look into what was going on inside their practice, bills were being put on credit cards more and more often. Cash flow problems, lack of management or income planning, and overwhelm were a regular occurance.

“When COVID hit and we were mandated to close the office, I was still really ignorant about the underpinnings of my practice. I don’t think I even realized how deficient things were. I mean, we had $30,000 in unpaid bills…not to mention the credit card debt! But when we had to close, those holes in my practice management got super overwhelming pretty quickly.”

Despite being closed for two months, Shannon & Molly overcame every obstacle and accomplished their goal of growth for the practice, paid off the past due bills and are now preparing for 2021 with a confident & hopeful attitude about the future.

How did they do it?

We interviewed Shannon & Molly to find out…

Shannon: Pretty good. I’ve really learned that anything is possible. I think we’re both starting to see the potential that this practice has is pretty much unlimited.

Silkin: Wow. Now, that’s a powerful shift from where you guys were at just nine months ago. Can you tell us – what really made the difference?

Molly: Our consultant at Silkin has been a buoy in the ocean for us. We were closed two whole months during COVID, and that was pretty scary. But we were really able to lean into her. I remember this one moment where, after we had a meeting, I had to call her back and ask her for an action item list. I was just so overwhelmed and frightened, I couldn’t even think! She helped us out of that.

It was like we were drowning – just truly drowning, even before COVID hit. And there we were, floating on the ocean. Our Silkin consultant stayed calm and got us to get back into the boat and we just all started rowing together.

Silkin: Incredible. You mention struggles that were happening before COVID hit, can you elaborate on that?

Shannon: COVID exposed a lot of weaknesses and deficiencies in our practice, and also in our marriage. We had just gotten started with Silkin. I remember, we attended the Basic Management Workshops in Portland, and returned home, and two weeks later we were mandated to close. My Office Manager and I had just gotten all excited about all these new things we learned, and wanted to implement in the practice! And then we were shutting down and it was like, “What do we do now?”

Molly: We give our consultant utter credit for saving our practice and our marriage and helping us learn how to not just survive, but really thrive this year.

I stepped into the role of CFO for the practice this year, on Silkin’s suggestion. Honestly, it wasn’t what I wanted to do. I was really nervous about it – what would that look like for me? What kind of time investment was it?

Silkin: Because you’ve got four kids at home, isn’t that right?

Molly: All of them now out of school! But I was intrigued with the idea of taking up this role. Our consultant saw something in me I wasn’t seeing myself. So I started taking over the financial management role, and right away her guidance and training on HOW to do income planning helped us keep our heads above water.

Shannon: She turned us into a partnership.

Molly: Yes! We really weren’t looking at the practice as a financial asset. She helped us see that is what it is – the biggest asset our family owns right now. And seeing that potential helped me face the enormous overwhelm of what we had to do. That’s the magic of Silkin – you’ve really helped us get down to the root cause behind all of the problems we were having.

Silkin: Thank you for sharing your story! So tell us, what do the next twelve months hold for you?

Shannon: We’re excited to have signed up for another year. My dream was to make this practice our sole support and I’m finally feeling like we now have a plan to accomplish all our other goals, too. I love that our consultant regularly asks us our goals – not just in the practice, but what those quotas MEAN to me. How it will affect my family, me personally, what we want to accomplish for our community, too.

We had growth this year, in spite of being closed down. By the end of next year, I see the practice in an even better position, less debt, more savings. But I also see us accomplishing our personal goals.

Silkin: If you could mentor a new Silkin client, what advice would you give them for getting the most out of their first year of consulting?

Shannon: Meet with your consultant twice a week! (laugh) But seriously, we just wish we had started sooner. We had hired another consulting firm before we came to Silkin…that didn’t work out.

Molly: We tell everybody that story! The difference between Silkin and other firms is night and day.

Shannon: If I could sit down with a new Silkin client and give them just one tip…be brutally honest with your consultant.

It’s not that I was dishonest – I wasn’t holding anything back. But I didn’t know how to LOOK at my practice. I didn’t know what information to give my consultant so she could do her job. Luckily she knew and asked all the right questions! I had to learn how to peel the bandages off to get at the gaping wounds my practice had.

I think I had this attitude when we started that I was doing okay. That’s a total lie. If I could go back, I would be brutally honest about the problems I was facing, and the things I was struggling with. We would have been even further along now.

Silkin: Good tip! Thank you so much Shannon & Molly for joining us today.